The Real Cost of Living in Dallas–Fort Worth in 2026

By Ana Cruz - Founder and Chief Editor

Housing, groceries, transportation, and childcare—what locals need to know.

I don’t know about you, but last year in our home it felt like we couldn’t save one single dollar—not even for our emergency fund.

In our household, both parents work. My husband brings in the majority through his corporate job, and I contribute as the founder of two businesses: DACAZA Investment (real estate) and Rollos de Mujeres Media (marketing & media agency). And still… after 20 years living in the U.S. (I moved here from Mexico), 2025 was the first year I truly felt stuck in the hamster wheel—working to live, and watching our bills drain our income month after month.

And I’m sharing this from a privileged place: we don’t carry unnecessary debt, we have two kids (not five), and we’re not navigating a major health crisis that would add thousands in medical costs.

So I asked myself: How is everyone else in the Metroplex doing? Has inflation hit your house too?

That’s what sent me down a rabbit hole: I wanted real numbers—data-backed, not just vibes—so we can understand where we are right now, and then (step two) build a smarter spending strategy that doesn’t feel like a financial horror movie.

Let’s get into it.

1) Housing: the big one (and yes, it’s still heavy)

Buying: “DFW is affordable”… compared to where?

Home prices vary wildly by city—and even by neighborhood—but here’s a quick snapshot:

Dallas: median sale price $458,000 (Nov 2025), up 11.7% YoY. Redfin

Plano: median sale price $520,000 (Nov 2025). Redfin

Arlington: median sale price $340,000 (Nov 2025). Redfin

Fort Worth: median sale price $321,000 (recent month shown on Redfin page). Redfin

Frisco: $675,000 Redfin

McKinney: $482,500 Redfin

Prosper: $875,000 Redfin

Translation: your zip code isn’t just a detail—it’s basically your financial destiny.

Renting: the monthly number people feel the most

Zillow’s January 7, 2026 rent snapshots show:

Dallas average rent: $1,995/month Zillow

Fort Worth average rent: $2,050/month Zillow

Arlington average rent: $1,999/month Zillow

Frisco: $2,895 / mes Zillow

McKinney: $2,370 / mes Zillow

Prosper: $3,000 / mes Zillow

Real talk: when rent is basically ~$2,000/month, it doesn’t take long before people feel like they’re “working just to pay the basics.”

2) Groceries: inflation didn’t disappear, it just got quieter (and sneakier)

Food prices in the Dallas–Fort Worth area were up 1.6% over the year ending Nov 2025. Grocery prices (“food at home”) rose 1.2%. Bureau of Labor Statistics

Now, what does that look like in actual dollars?

USDA publishes monthly “healthy-at-home” food budgets. For November 2025, the USDA Thrifty Food Plan (their lowest-cost nutritious plan) shows a reference family of four at $988.60/month. Food and Nutrition Service

That’s about $1,000/month just for food at home—before Costco “accidentals,” eating out, coffee runs, or the “we deserve a treat” moments (which… same).

3) Transportation: the “hidden subscription” nobody wants

If you own a car, you already know: it’s not just gas.

AAA estimates the average cost to own and operate a new vehicle in 2025 at $11,577 per year, and at 15,000 miles/year that’s about $0.77 per mile. AAA Newsroom

That’s roughly $965/month per vehicle (and many families have two).

If you use public transit in Dallas, DART notes the Local Monthly Pass increased to $126 (with the Day Pass at $6). DARTDaily

4) Childcare: the category that breaks people (quietly)

Childcare is one of those expenses that doesn’t just “pinch.” It can completely reshape a family’s life.

Child Care Aware of America’s 2024 affordability analysis reports average annual Texas costs for full-time center-based care of:

Infant: $11,349/year

Toddler: $10,921/year Child Care Aware

That’s about $945/month for an infant and $910/month for a toddler—roughly $1,856/month combined.

So when people say, “We can’t get ahead,” sometimes the math is simply:

rent + cars + childcare + groceries = the whole paycheck.

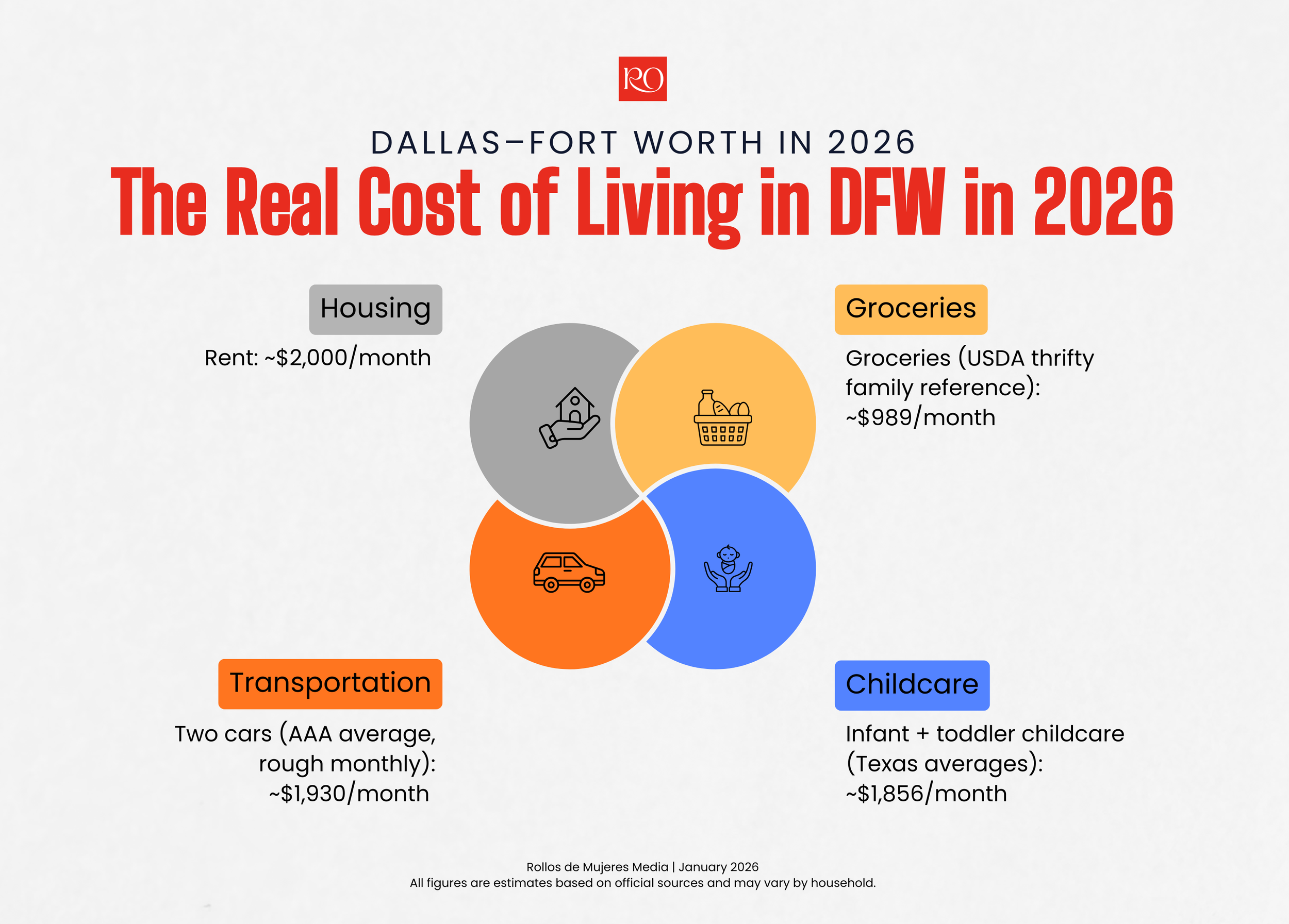

The “Core 4” monthly reality check (DFW family version)

Let’s do a simple, not perfect but very real example for a family renting in DFW:

Rent: ~$2,000/month Zillow

Groceries (USDA thrifty family reference): ~$989/month Food and Nutrition Service

Two cars (AAA average, rough monthly): ~$1,930/month AAA Newsroom

Infant + toddler childcare (Texas averages): ~$1,856/month Child Care Aware

Total for just those four categories: about $6,800/month.

And that’s before health insurance, tollway fees, house and car repairs, utilities, phones, internet, student loans, activities, diapers, haircuts, birthdays, and the random $287.46 charge you can’t remember approving.

If you’ve been feeling like, “We’re doing everything right but we’re still drowning,” you’re not alone—and you’re not crazy.

What I want you to do next (because data without action is just anxiety)

This article is Step One: reality.

Step Two is strategy:

Where is the money actually going?

What can we reduce without misery?

What do we automate so saving happens even when life is chaotic?

If you want, I’ll publish a follow-up with a simple DFW household spending framework (with real examples for: single adult, couple, family with kids).

FAQ (6 questions I keep hearing—and asking myself)

-

Compared to coastal cities, often yes—but affordability is personal. With average rents around $2,000/month Zillow and major categories stacking up fast, many families are feeling stretched even with two incomes.

-

USDA’s Thrifty Food Plan reference family is $988.60/month for Nov 2025. Food and Nutrition Service

If you eat out regularly or buy convenience foods, it climbs quickly. -

No. For example, Redfin shows Dallas up YoY while Plano was down YoY in the period shown. Redfin+1

Neighborhood matters. -

Because they are. AAA estimates ~$11,577/year per vehicle on average. AAA Newsroom

And that’s an “all-in” cost—depreciation, insurance, maintenance, and more. -

Child Care Aware reports $11,349/year for an infant and $10,921/year for a toddler (center-based care averages). Child Care Aware

-

Track just four categories for 30 days: housing, groceries, transportation, childcare.

Once you know your “Core 4,” you’ll immediately see what’s realistic—and what needs a plan.

If you’ve been feeling that “hamster wheel” tension too—where the paycheck comes in and somehow disappears—please know you’re not alone, and you’re not imagining it. The numbers make it clear: in 2026, DFW affordability is less about one big expense and more about how housing, groceries, transportation, and childcare stack on top of each other.

This is exactly why I’m building Rollos de Mujeres Magazine as a practical, bicultural guide for life in the Metroplex—not just to talk about what’s happening, but to help us respond with clarity and a plan.

If you want more data-backed stories like this (plus simple, real-life strategies to protect your peace and your wallet), subscribe to the magazine. We’ll send new articles straight to your inbox so you don’t miss what matters.

And now I want to hear from you: Have you felt the cost of living hit your home in 2025–2026? Which category is the toughest for your family right now—housing, groceries, transportation, or childcare?

👇 Leave a comment below. I read every single one.